The financial institution run that began in March 2023 within the U.S. occurred at an unusually speedy tempo, suggesting that depositors have been shocked by these occasions. On condition that public information revealed financial institution vulnerabilities as early as 2022:Q1, have been different market contributors additionally shocked? On this publish, primarily based on a current paper, we develop a brand new, high-frequency measure of financial institution steadiness sheet danger to look at how inventory market buyers’ danger sensitivity developed across the run. We discover that inventory market buyers solely grew to become attentive to financial institution danger after the run and solely to the danger of a restricted quantity (lower than one-third) of publicly traded banks. Surprisingly, buyers appear to have largely targeted on media publicity and never fundamentals when evaluating financial institution danger. In a companion publish, we look at how the Federal Reserve’s liquidity help affected investor danger perceptions.

How Dangerous Had been Banks Earlier than the Financial institution Run?

We emphasize two steadiness sheet options that turned out to be significantly problematic through the financial institution run: the share in complete property of uninsured deposits (denoted UID) and the share in complete property of unrealized losses on securities held in accounts not meant for buying and selling (denoted Losses). Excessive values of UID proved to be dangerous as they have been concentrated in sure sectors, which heightened the danger of speedy withdrawals. When Losses are excessive (usually when rates of interest are growing, as in 2022) and finally realized, financial institution capital is extra prone to be eroded under regulatory limits.

To benchmark financial institution danger, we assemble 4 teams of publicly traded banks that have been differentially affected through the financial institution run: distressed banks that have been downgraded in April 2023, giant regional banks (these included within the Regional Banking Index, or KRX) that have been on the coronary heart of the disaster, small regional banks (these with property higher than $10 billion that aren’t included in any financial institution index), and stress-tested banks, or STBs (the big banks that participated within the Federal Reserve stress exams of 2022 and which might be included within the broad financial institution index, or KBW).

The chart under reveals the median values of UID (left panel) and Losses (proper panel) in 2022 by financial institution group. For reference, we additionally embrace the three banks that failed in March 2023 (Silicon Valley Financial institution, Signature Financial institution of New York, and Silvergate Financial institution), though they aren’t a part of our evaluation. Financial institution vulnerabilities have been obvious way back to 2022:Q1. Banks that might later fail or be distressed stood out with the very best ranges of UID and Losses. Notably, Losses elevated for all financial institution teams because the Federal Reserve raised charges, peaking in Q3. Whereas giant regional banks didn’t have atypical ranges of UID, they’d extra Losses than smaller regionals and STBs.

Financial institution Vulnerabilities Had been Obvious in 2022

Sources: Federal Reserve Board, Consolidated Monetary Statements of Financial institution Holding Firms (FR Y-9C information); Federal Monetary Establishments Examination Council, Consolidated Reviews of Situation and Earnings (Name Reviews).

Notes: The chart reveals the median asset shares of uninsured deposits (UID) and unrealized securities losses (Losses) in 2022 by teams of publicly traded banks. Failed banks are people who have been liquidated or failed in March 2023. Distressed banks are people who have been downgraded in April 2023. Giant regional banks include non-downgraded regional banks within the Regional Banking Index (KRX). Small regional banks are these with property of a minimum of $10 billion that weren’t included in any financial institution index. Stress-tested banks have been a part of the Federal Reserve’s stress exams in 2022 and a part of the broad financial institution index KBW.

Did Inventory Market Buyers Monitor Dangerous Banks?

Our novel measure of financial institution steadiness sheet danger is constructed as follows. First, we calculate the common inventory returns of a portfolio of banks with a selected steadiness sheet attribute (similar to UID) in 2022:Q3. For instance, the UID portfolio return is the common distinction in inventory returns of banks with the very best UID minus these with the bottom UID in 2022:Q3. If banks with greater UID are riskier, this issue is anticipated to have a optimistic return on common (to compensate inventory market buyers for the higher danger).

Subsequent, to measure how buyers perceived the UID danger of a financial institution, we estimate the co-movement of a financial institution’s extra inventory returns with the UID portfolio return, after accounting for different varieties of danger (for instance, dimension, worth, and inventory market danger). We denote this co-movement because the UID beta. If a financial institution’s UID beta will increase, this means that buyers are extra delicate to the financial institution’s systematic UID danger. We assemble the Losses beta utilizing an similar process. (Our paper additionally constructs betas with respect to money and regulatory capital.)

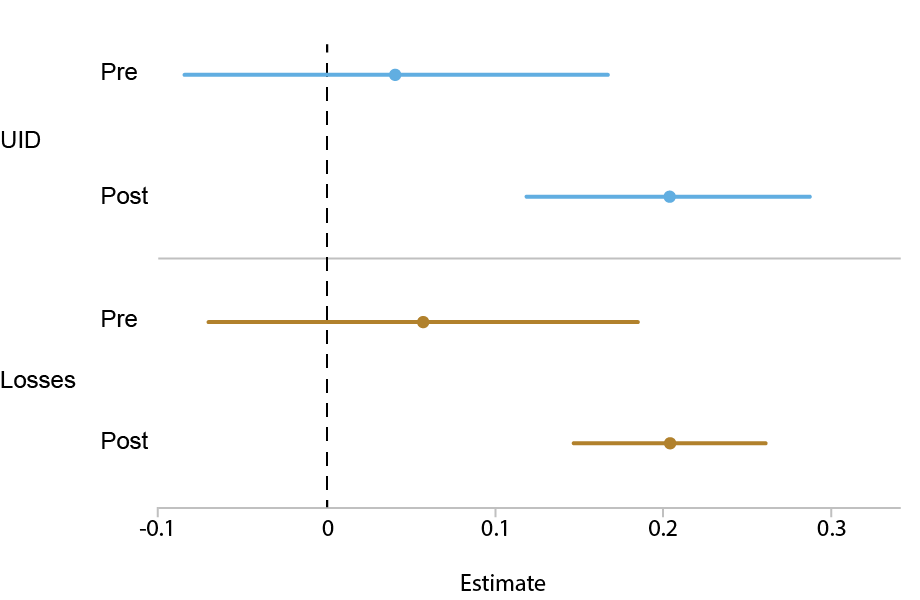

The chart under reveals estimates (indicated by the dots) of the common UID beta and Losses beta for all banks earlier than the run (January–February 2023; Pre within the chart) and through the run (March 1–Might 5, 2023; Submit within the chart). The traces by the dots point out confidence intervals. The chart reveals that, earlier than the run, the betas weren’t statistically totally different from zero (because the confidence interval straddles zero). However after the run the betas grow to be optimistic and statistically vital. In different phrases, buyers largely ignored dangers from excessive ranges of uninsured deposits and unrealized losses on securities—till the disaster really hit.

Buyers Largely Ignored Financial institution Danger Till the Financial institution Run Hit

Notes: The chart reveals the estimates of the UID beta and Losses beta utilizing information from January 3 to Might 5, 2023. Pre signifies the pre-bank-run interval outlined as earlier than March 1, 2023. Submit signifies the post-bank-run interval outlined as since March 1, 2023. The dots point out the estimates, whereas the traces point out the 95 % confidence interval of the estimates.

Which Banks Did Buyers Run On?

On the particular person financial institution degree, we discover that the betas elevated through the run for a few third of all publicly traded banks. Thus, investor issues about financial institution danger have been seemingly not broad-based. What characterised this restricted set of banks? Surprisingly, we discover that steadiness sheet variables as of 2022:Q3 or This fall fail to foretell which banks had considerably greater betas through the run. In different phrases, banks perceived as riskier by buyers through the run have been seemingly not those with worse fundamentals in 2022.

How Information Drove Danger Perceptions

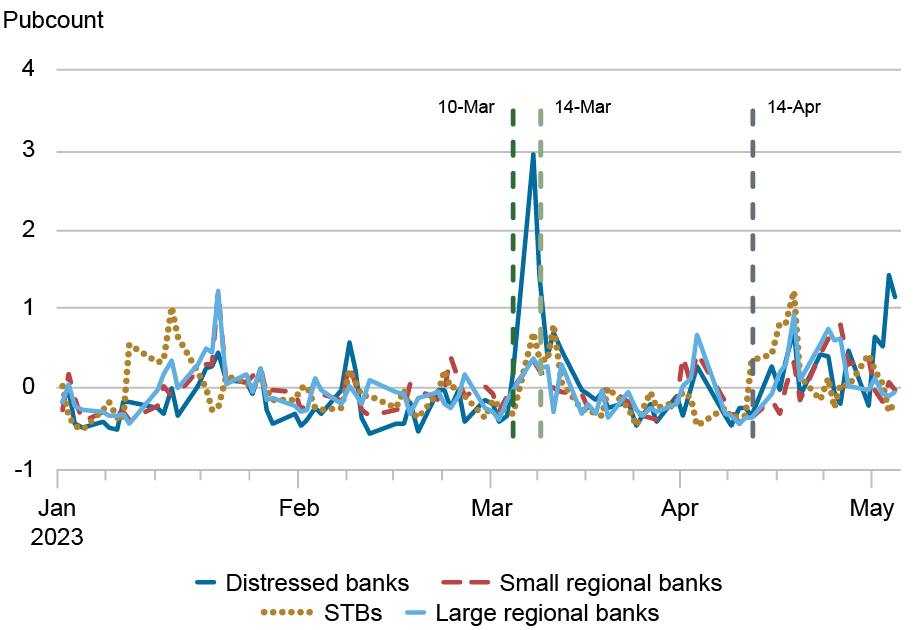

If fundamentals didn’t drive investor consideration, then what did? We think about whether or not information protection facilitated the coordination of investor consideration on sure banks. Such a risk has beforehand been discovered within the context of financial institution failures. We outline a financial institution’s information protection because the variety of articles a few financial institution on a given day divided by the financial institution’s property, to account for bigger banks having extra publications. We denote this variable Pubcount. Within the chart under, Pubcount (measured as deviations from zero, and in commonplace deviation models) reveals appreciable each day variation, implying that even banks with low common media protection expertise durations of comparatively intense publicity. By March 8, simply earlier than the disaster, Pubcount was unfavourable (i.e., under common) for all teams. When some distressed banks have been placed on a downgrade watch by Moody’s after the markets closed on March 13, Pubcount spiked for all distressed banks. Media curiosity surged once more when the distressed banks have been downgraded beginning on April 14. Typically, it seems that will increase in Pubcount are related to danger occasions.

Financial institution Publications Improve Round Danger Occasions

Notes: The chart reveals the common time sequence of Pubcount, or publication counts, divided by property, by financial institution group. Pubcount is standardized to have a imply of zero and commonplace deviation of 1. Distressed banks are people who have been downgraded in April 2023. Giant regional banks include non-downgraded regional banks within the KRX financial institution index. Small regional banks are these with property of a minimum of $10 billion that weren’t included in any financial institution index. Stress-tested banks (STBs) have been a part of the Federal Reserve’s stress exams in 2022 and a part of the broad financial institution index KBW.

Does information protection have an effect on the steadiness sheet betas? Within the chart under, we present estimates of reports betas (or the part of betas that change with Pubcount) across the financial institution run. These information betas are considerably unfavourable earlier than the run (i.e., publications have been related to decrease investor danger sensitivity) however grew to become considerably optimistic through the run (i.e., publications have been related to greater investor danger sensitivity). These results are economically significant because the information betas are a minimum of as giant because the non-news betas. The impact of reports on the betas continued for days after publication, suggesting that buyers paid consideration to information solely when it grew to become salient to them.

Investor Danger Sensitivities Elevated with Financial institution Information Protection Through the Financial institution Run

Notes: The chart reveals the estimates of reports and non-news elements of the UID and Losses beta utilizing information from January 3 to Might 5, 2023. Pre signifies the pre-bank-run interval outlined as earlier than March 1, 2023. Submit signifies the post-bank-run interval outlined as since March 1, 2023. The dots point out the estimates, whereas the traces point out the 95 % confidence interval of the estimates.

When a financial institution appeared within the information through the disaster, buyers grew to become far more delicate to its dangers—regardless of whether or not the financial institution had a riskier steadiness sheet than its friends. This consequence reinforces the notion that information protection coordinated buyers’ actions (and thereby their perceptions of financial institution danger), both as a result of it mirrored latent danger occasions not captured by steadiness sheet information, or as a result of buyers overreacted to the information.

Closing Phrases

Through the financial institution run of 2023, information flows have been a minimum of as necessary as underlying financial institution fundamentals in driving investor perceptions of financial institution danger. Information protection, even when stale, appeared to have served as a coordination gadget, serving to buyers focus collectively on sure banks. These outcomes indicate that buyers could also be unable to rapidly course of data in a disaster, doubtlessly making market worth dynamics noisier, to the detriment of market contributors and policymakers. Nevertheless, as investor consideration was targeted on a number of banks relatively than a broad swathe of the banking sector, the contagion was contained. Liquidity help by the Federal Reserve can also have restricted contagion, a subject we look at in our companion publish.

Natalia Fischl-Lanzoni, a former analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group, is pursuing a grasp’s in laptop science at NYU Courant.

Martin Hiti, a former analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group, is a Ph.D. scholar in finance on the MIT Sloan Faculty of Administration.

Asani Sarkar is a monetary analysis advisor within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Tips on how to cite this publish:

Natalia Fischl-Lanzoni, Martin Hiti, and Asani Sarkar, “Studying the Panic: How Buyers Perceived Financial institution Danger Through the 2023 Financial institution Run,” Federal Reserve Financial institution of New York Liberty Avenue Economics, September 30, 2025, https://doi.org/10.59576/lse.20250930a

BibTeX: View |

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).