A blockchain is a distributed database the place unbiased computer systems internationally keep similar copies of a transaction document, updating it solely when the community reaches consensus on new transactions—making the historical past clear and terribly tough to change. Traditionally, bonds have traded nearly totally in over-the-counter (OTC) markets, whereas equities and cash market fund shares have largely settled by way of centralized infrastructures resembling inventory exchanges and central securities depositories. In each settings, every establishment maintains its personal data, and post-trade steps like affirmation, clearing, and settlement require a number of intermediaries and repeated reconciliation.

Blockchain gives a unique mannequin: as a substitute of fragmented books or a single central authority, all individuals share a single, consensus-validated ledger of possession and transactions. A tokenized asset—whether or not a bond, fairness, or cash market fund share—is a digital illustration of that declare on the blockchain, with transfers recorded as direct updates to this shared ledger. Whereas distributed ledgers aren’t inherently quicker or cheaper than centralized programs, they differ in vital methods: no single entity controls the document; programmable logic can automate company actions or implement switch restrictions; and auditability is native by way of an append-only historical past.

On this method, blockchain replaces bilateral and centrally ruled recordkeeping with a typical ledger that’s collectively maintained and verifiable in actual time. Whereas many forms of belongings have been tokenized thus far, we concentrate on the tokenization of “money-like” funding funds that doubtlessly enable for novel use circumstances. We offer a background of how these merchandise have advanced and focus on their use circumstances. In a subsequent publish, we look at the advantages and dangers to monetary stability from these merchandise.

Background

Many forms of belongings have been tokenized thus far, together with actual property, commodities, agriculture, and different monetary securities. However the bulk of tokenization exercise in the US has targeting two forms of funds: cash market funds (MMFs), that are open-end funds registered underneath the Funding Firm Act of 1940 (1940 Act), and personal funds which might be exempt from registration underneath that Act. A number of personal funds have been proposed by giant monetary establishments, suggesting surging curiosity amongst market individuals and the opportunity of wider adoption.

Personal funds are exempt from lots of the necessities in federal securities legal guidelines and rules relevant to MMFs, together with the 1940 Act’s disclosure necessities for funding firms. Consequently, regulators and the general public have little visibility into their operations, together with whether or not they have instituted the identical sort of liquidity threat administration instruments as MMFs are required to implement (for instance, portfolio maturity maximums and liquid asset minimums).

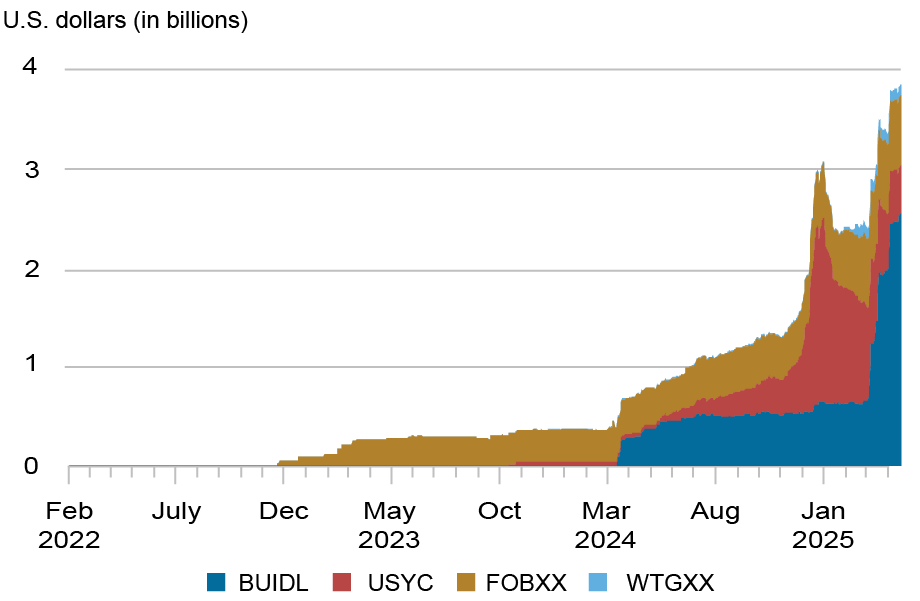

Three outstanding tokenized MMFs are Franklin Templeton’s FOBXX (AUM $708M), Circle/Hashnote’s USYC ($488M) and WisdomTree’s WTGXX ($10.8M); the biggest tokenized personal fund is BlackRock’s BUIDL (AUM $2.5B). The chart beneath exhibits the expansion of those 4 tokenized funds.

Whole Property Underneath Administration of Choose Tokenized Funds

Use Circumstances

Three outstanding use circumstances of tokenized funds have been developed thus far, all of that are novel as they’ve traditionally not been obtainable to funding funds as a consequence of quite a few authorized, regulatory, and/or market causes. See, for instance, “Classes from the Historical past of the U.S. Regulatory Perimeter” for a way the authorized perimeter has advanced in the US, separating deposit liabilities, that are thought of authorized fee devices, from different sorts resembling funding funds’ liabilities, which aren’t.

Use Case I: Growth of a Secondary Market and Instantaneous Liquidity Swimming pools

Traders might wish to maintain tokenized shares past their conventional operate as a retailer of worth. For instance, tokenization permits shares to flow into as a medium of alternate in secondary markets. Such a risk could be facilitated by modern efforts to supply fast liquidity towards tokenized shares. For example, some fund issuers have established processes by which their tokenized shares might be exchanged for extra extensively used technique of digital-asset funds, particularly stablecoins. A outstanding instance is the smart-contract-controlled pool the place BUIDL and FOBXX are instantaneously exchangeable for USDC, the second-biggest stablecoin by market capitalization. These initiatives allow a deeper integration of tokenized funds with the digital-asset ecosystem, thereby growing advantages to traders of tokenized funds, as they will use their shares to transact in methods traditionally unavailable to such shares.

Use Case II: Reserve Asset for DeFi-based Merchandise

Tokenization may facilitate the usage of the shares for use as a retailer of worth within the digital-asset ecosystem. For instance, not less than three DeFi-based merchandise use BUIDL as a reserve asset. One such product is Ondo Finance’s “Brief-Time period U.S. Authorities Treasuries” (OUSG). Just lately, Ondo introduced it will alternate shares of OUSG for shares in 4 tokenized MMFs (FOBXX, WTGXX, and two worldwide funds). Ondo plans to then maintain the acquired shares as a part of OUSG’s reserve belongings that are predominantly made up of BUIDL. In essence, OUSG serves for example of the secondary market performance mentioned above with an elevated position for tokenized shares to be a retailer of worth within the digital-asset ecosystem, whereas additionally offering extra liquidity for token holders given the 24/7 on-off ramp by which tokenized funds might be not directly exchanged for stablecoins. Whereas Ondo may have used stablecoins as collateral instantly, this may have been much less engaging as a retailer of worth since stablecoins don’t pay curiosity. As well as, each Mountain Protocol’s stablecoin and the rebranded FRAX stablecoin declare that BUIDL contains a portion of their reserve belongings.

Use Case III: Collateral for Derivatives

A 3rd use case for tokenized shares is posting margins for repurchase agreements and derivatives transactions. Bloomberg experiences that two of the world’s largest crypto prime brokers enable shoppers, together with hedge funds, to make use of BlackRock’s BUIDL as collateral for crypto-based derivatives buying and selling and are in early talks with among the world’s largest crypto exchanges to develop this providing. Furthermore, Circle just lately bought Hashnote, the issuer of the world’s largest tokenized MMF to “emerge as a most well-liked type of yield-bearing collateral on crypto exchanges, and likewise with custodians and prime brokers.” In the meantime, in conventional derivatives, JPMorgan Chase facilitated a transaction by which tokenized BlackRock MMF shares had been pledged as collateral with Barclays for a derivatives contract, though there haven’t been any extra transactions thus far.

Remaining Phrases

It’s too early to inform what influence, if any, tokenized shares may have on the monetary system. So far tokenized shares have been primarily facilitating use circumstances throughout the digital-asset ecosystem. Whereas there exists numerous opacity in how these tokenized funds are getting used in addition to restricted proof of broader acceptance up to now, interconnections between the normal monetary system and digital belongings may enhance if these merchandise are used extra broadly by market individuals sooner or later.

Pablo Azar is a monetary analysis economist within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Francesca Carapella is a principal economist within the Macroprudential Coverage Evaluation Part on the Federal Reserve Board.

JP Perez-Sangimino is a senior coverage analyst in Innovation Coverage on the Federal Reserve Board.

Nathan Swem is a principal economist within the Monetary Stability Evaluation Part on the Federal Reserve Board.

Alexandros P. Vardoulakis is chief of the Macroprudential Coverage Evaluation Part on the Federal Reserve Board.

The way to cite this publish:

Pablo Azar, Francesca Carapella, JP Perez-Sangimino, Nathan Swem, and Alexandros P. Vardoulakis, “The Emergence of Tokenized Funding Funds and Their Use Circumstances,” Federal Reserve Financial institution of New York Liberty Road Economics, September 24, 2025, https://doi.org/10.59576/lse.20250924a

BibTeX: View |

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).